Overview On Taxation Harmonization Law Vol. I - Amendments To Income Tax Law And VAT Law

General Overview on HPP Law: The Government of Indonesia issued Law No. 7 of 2021 on Harmonization of Taxation Regulation (Harmonisasi Peraturan Perpajakan or "HPP Law"), which amended several material issues in the Indonesian Taxation Law. HPP Law was promulgated on 29 October 2021 and most of the provisions will become effective in the fiscal year 2022.

Similar to Job Creation Law, HPP law mainly provides amendments to some provisions under the preceding tax laws (i.e., Law No. 11 of 1995 on Excise, as amended by Law No. 39 of 2007, Law No. 6 of 1983 on General Provisions and Procedures on Taxation, as lastly amended by Law No. 16 of 2009), as well as introduces new taxes such as the new Carbon Tax.

These provisions and the effective dates of such amendments and/or new provisions are as follows:

- amendment to the General Provisions and Tax Procedures, effective as of 29 October 2021;

- amendment to the Income Tax Law, effective on the start of fiscal year 2022 (i.e., 1 January 2022);

- amendment to the Value Added Tax Law, effective as of 1 April 2022;

- Taxpayer Voluntary Disclosure Program for the period between 1 January and 30 June 2022;

- Carbon Tax, effective as of 1 April 2022; and

- Excise Law, effective as of 29 October 2022.

Aim of the HPP Law: Based on Article 1 (2) of HPP Law, its issuance is aiming at:

- promoting sustainable economic growth and supporting the acceleration of the economic recovery;

- optimizing the state revenue;

- providing fairer tax system and legal certainty;

- stipulating administrative reform and tax base expansion; and

- improving voluntary compliance of taxpayers.

Although the law is made to promote sustainable economic growth and recovery from the pandemic induced effect, the Indonesian general public and businesses' most concern of the direct economic effect of HPP Law, including the proposed raise of VAT from 10% to 11%. Many experts and practitioners view that the law was issued to provide the government with a "source of funding" to cut the deficit in the state budget during Covid-19 pandemic. This appears to be a non-traditional and unique approach, especially compared to other countries' approaches on taxation during this time.

Although the spirit of HPP Law looks good on the surface, the long-term effect on businesses and the public alike might be concerning.

Scope of Analysis: In this article, we provide a summary of the key points of the amendments and new provisions of HPP Law. Given that the law provides many substantial changes to taxation laws, we address these key points in two separate articles. In this volume, we only address the amendments to (i) Income Tax Law and (ii) VAT Law.

A. Amendment to the Income Tax Law

HPP Law amended some provisions of Law No. 7 of 1983 on Income Tax, which was lastly amended by Law No. 11 of 2020 on Job Creation ("Income Tax Law")

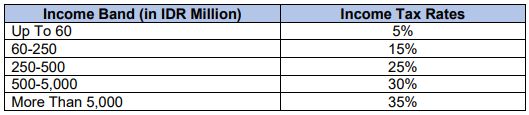

The key amendments include that on the income tax rates, which are determined progressively based on the income band ("Income Band").

Pursuant to Art. 3 (7) of HPP Law, the minimum and maximum thresholds of income band, subject to the progressive income tax rates, are increased to IDR60 million as the minimum threshold, and IDR50 billion as the maximum threshold ("Income Band"). Such changes are reflected in the new tax rates:

Please note that the Income Band refers to the total annual income as reported in the Taxpayer's Annual Tax Return.

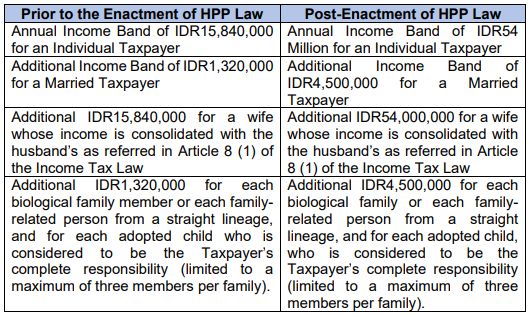

HPP law also introduces the following provisions on the exclusion of certain amounts in the calculation of the progressive Income Band:

Furthermore, HPP Law stipulates that the business income of an Individual Taxpayer with a gross turnover of up to IDR500 million in a single tax year is categorized under the Micro, Small, Medium Enterprises (MSME) tax rate, and will not be subject to the income tax.

Lastly, the Corporate Income Tax Rate for Corporate Taxpayer will remain at 22% in 2022, as the initially planned 20% rate is cancelled.

B. Amendment to VAT Law

Pursuant to Article 17 (2) of HPP Law, the provisions amending the VAT Law shall become effective as of 1 April 2022. The changes in VAT Law are as follows:

- Expansion of Tax Base by Removing Most of the Negative List on VAT Exemption: Article 4 (1) of the HPP Law provides certain goods and services that are no longer exempted from VAT with the following details:

- Goods and/or services that are removed from VAT exemption: taxable goods from mining and drilling results taken directly from the sources, which exclude coal, gold bars other than those for the government's forex reserve, non-advertising broadcasting services, postal services, public phone services, and money transfer by postal services.

- Goods and/or services, which remain exempted from VAT but subject to other requirements:

- Subject to Regional Tax: F&B served in hotels or restaurants, hotel parking, catering, and arts-and-entertainment services;

- Public services provided by the government that cannot be provided by other parties.

- VAT-able strategic goods and/or services exempted from VAT: basic necessities, medical services, financial services, insurance services, education services, non-profit social services, public transportation of all modes of transportation, and manpower services.

Possible Impact: Removal of these goods and services from VAT exemption can be both beneficial or less beneficial for various stakeholders.

From the consumers' point of view, this could be burdensome, especially in terms of fulfilling their basic needs. From the perspective of the government that has witnessed progress of business development in MSME sectors, specifically F&B, the pandemic has also caused so much negative impact on the economy.

- Goods and/or services that are removed from VAT exemption: taxable goods from mining and drilling results taken directly from the sources, which exclude coal, gold bars other than those for the government's forex reserve, non-advertising broadcasting services, postal services, public phone services, and money transfer by postal services.

- The Changes in VAT Rate: The most worrisome change in the VAT Law under HPP Law is the change of VAT rate that would be gradually increased from 10% to 12%.

The rate increase from 10% to 11% will be effective as of 1 April 2022, and the increase from 11% to 12% will be effective no later than 1 January 2025.

C. NLP Closing Remarks on HPP Law

Amendments on taxation provisions under HPP Law are quite controversial and will definitely have substantial impacts on daily life and businesses in Indonesia. In the eyes of the Indonesian tax authority and the Ministry of Finance, such changes are not always unbeneficial as they support the middle to lower-middle classes with the haves paying more taxes.

It remains to be seen how the enforcement of the law will impact the public and state income. Many people still have a great concern over the inflation caused by this tax reform that will likely increase prices and living costs in Indonesia.

The article above was prepared by Marshall S. Situmorang (Partner) and Audria Putri (Senior Associate).

Disclaimer: The information herein is of general nature and should not be treated as legal advice, nor shall it be relied upon by any party for any circumstance. Specific legal advice should be sought by interested parties to address their particular circumstances.